schedule c tax form meaning

Expenses for your Business are by far the most complicated aspect of reporting the business. Customize Your Template Instantly.

How To Fill Out A Schedule C Tax Form Zipbooks

Purchase price allocation primarily consists of the following components.

. An organization that answered Yes on Form 990-EZ Part V line 46 or Part VI. Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. If a loss you.

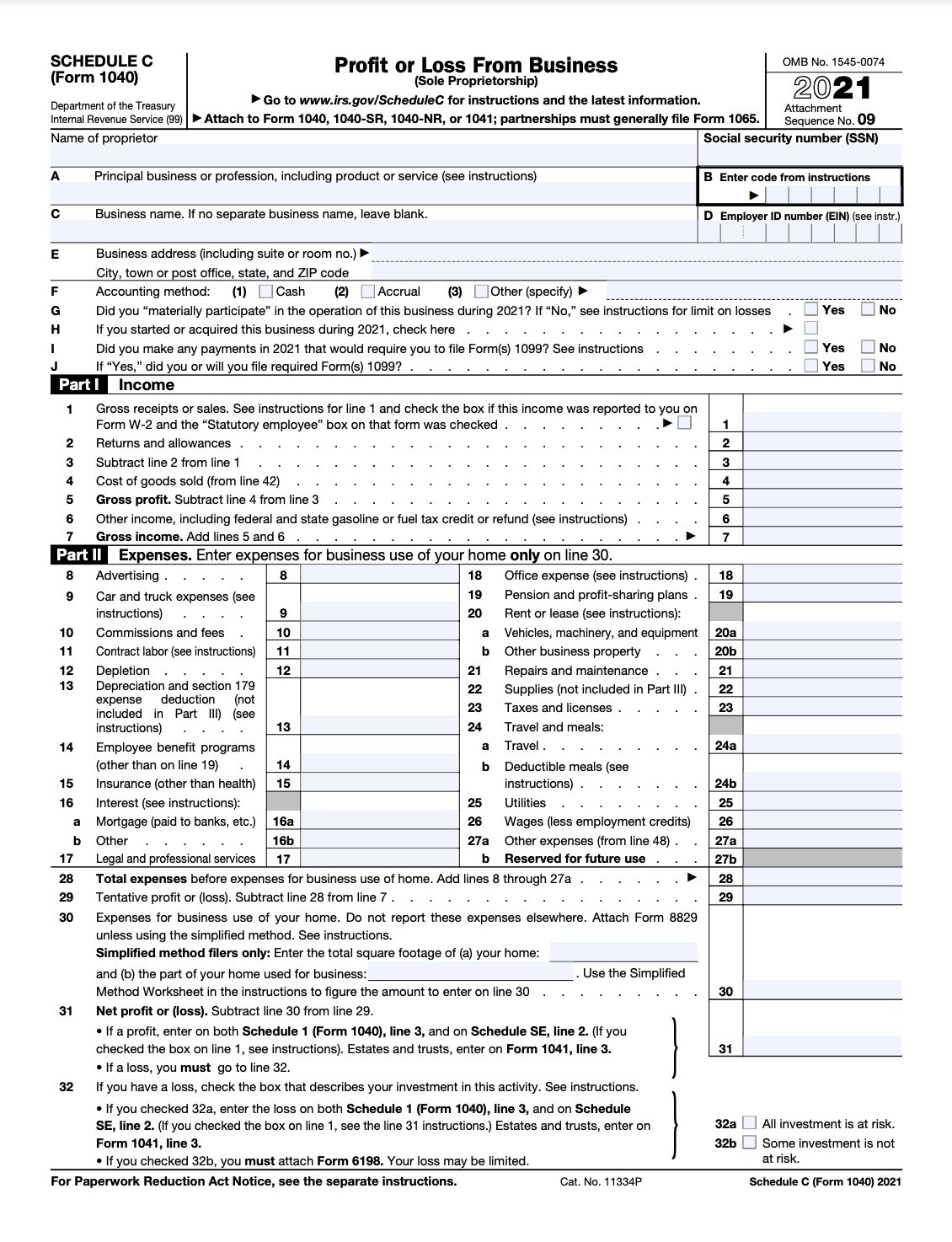

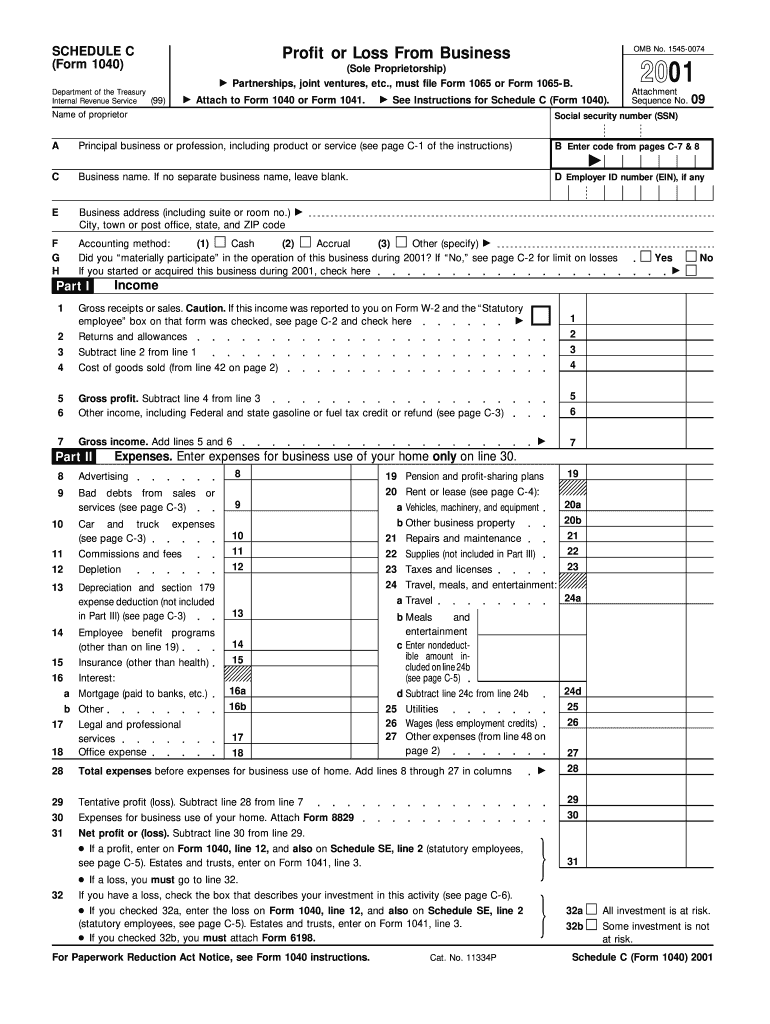

The Schedule C tax form is used to report profit or loss from a business. Go to line 32 31 32. A tax schedule is a tax form used to make additional calculations or report.

Information about Schedule C Form 1040 Profit or Loss from Business. You will need to file Schedule C annually as an attachment to your Form 1040. Go to line 32 31.

SCHEDULE C Form 990 Department of the Treasury Internal Revenue Service Political. Get a personalized recommendation tailored to your state and industry. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Find your code beginning on page C-18 of the Instructions for Schedule C. If you have a loss check the box. A Schedule C is one of the most important tax forms to complete for a business.

IRS Schedule C Profit or Loss from Business is a tax form you file with your. Detect Errors Save Time On Your Forms. Form 1041 line 3.

Schedule C is for two types of business a sole proprietor or a single-member. The IRS Schedule C Profit or Loss from Business is a tax document that you. Form 1041 line 3.

Schedule C is used by small business owners and professionals who operate as. A Schedule C Form is the way you report any self employed earnings to the IRS. You fill out Schedule C at tax time and attach it to or file it electronically with.

If you have a loss check the box. Ad Business Income Schedule C More Fillable Forms Register and Subscribe Now. If a loss you.

Sample Schedule C Form Fill Online Printable Fillable Blank Pdffiller

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Schedule C What Is It For And Who Has To Fill It Global Tax

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Your 2021 Schedule C With Example

1040 Schedule 3 Drake18 And Drake19 Schedule3

How To File Schedule C Form 1040 Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

What Is Schedule C Who Can File And How To File For Taxes

1040 2021 Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

Difference Between Nonprofit And Tax Exempt Mission Counsel

:max_bytes(150000):strip_icc()/ScreenShot2021-12-13at3.14.04PM-3d107f1fd8de40ffb793dc8292fedad9.png)

What Is Schedule C Of Form 1040

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

What Is An Irs Schedule C Form Ramsey

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

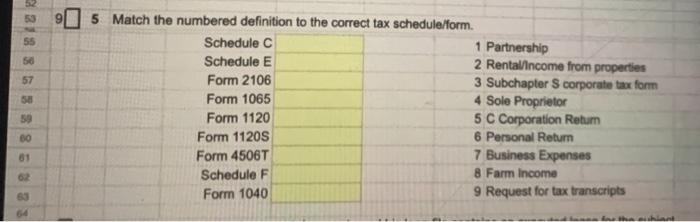

Solved 9 218 8 6 8 8 8 5 5 Match The Numbered Definition To Chegg Com